China is now removing travel restrictions rapidly, both domestically and internationally. While the sudden opening may lead to uncertainty and hesitancy to travel in the short term, Chinese tourists still express a strong desire to travel. And the recent removal of quarantine requirements in January 2023 could usher in a renewed demand for trips abroad.

Domestically, there are already signs of strong travel recovery. The recent Chinese New Year holidays saw 308 million domestic trips, generating almost RMB 376 billion in tourism revenue. This upswing indicates that domestic travel volume has recovered to 90 percent of 2019 figures, and spending has bounced back to around 70 percent of pre-pandemic levels.

This article paints a picture of Chinese travelers and their evolving spending behaviors and preferences—and suggests measures that tourism service providers and destinations could take to prepare for their imminent return. The analyses draw on the findings of McKinsey’s latest Survey of Chinese Tourist Attitudes, and compare the results across six waves of surveys conducted between April 2020 and November 2022, along with consumer sentiment research and recent travel data.

From pandemic to endemic

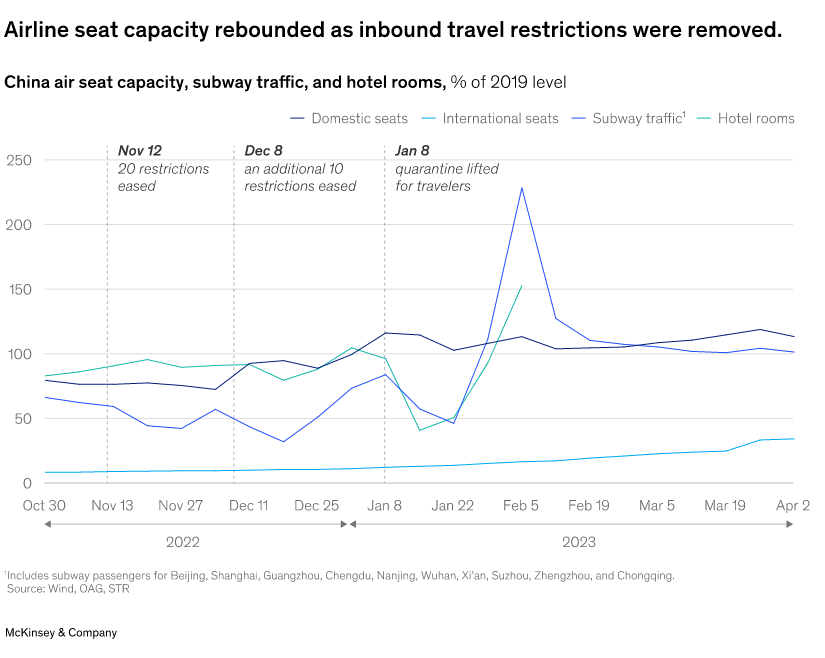

By January 8, 2023, cross-city travel restrictions, border closures, and quarantine requirements on international arrivals to China had been lifted. This rapid removal of domestic travel restrictions, and an increase in COVID-19 infection rates, likely knocked travel confidence for cross-city and within-city trips. Right after the first easing of measures, in-city transport saw a marked drop as people stayed home—either because they were ill, or to avoid exposure. Subway traffic in ten major cities in mainland China fell and then spiked during Chinese New Year in February. Hotel room bookings also peaked at this time.

Domestic airline seat capacity experienced a minor rebound as each set of restrictions was lifted—suggesting a rise in demand as airlines scheduled more flights. Domestic capacity fluctuated, possibly due to the accelerated COVID-19 infection rate and a temporary labor shortage. International seat capacity, however, continued to climb (Exhibit 1).

Exhibit 1

By Chinese new year, China was past its infection peak—and domestic tourism recovered strongly. For instance, Hainan drew 6.4 million visitors over Chinese New Year (up from 5.8 million in 2019) and visits to Shanghai reached 10 million (roughly double 2019 holiday figures). Overall, revenue per available room (RevPAR) during this period recovered and surpassed pre-pandemic levels, at 120 percent of 2019 figures.5 Outbound trips are still limited, but given the pent-up demand for international travel (and the upswing in domestic tourism) the tourism industry may need to prepare to welcome back Chinese tourists.

Tourism players should be ready for this; the time to act is now.

A demand boom is around the corner—Chinese tourists are returning soon

Before the pandemic, Chinese tourists were eager travelers. Mainland China had the largest outbound travel market in the world, both in number of trips and total spend. In 2019, Mainland Chinese tourists took 155 million outbound trips, totaling $255 billion in travel spending. China is also an important source market for some major destinations. For instance, Chinese travelers made up 28 percent of inbound tourism in Thailand, 30 percent in Japan, and 16 percent of non-EU visitors to Germany.

Leisure travel was the biggest driver of China’s outbound travel, representing 65 percent of travelers in 2019. In the same year, 29 percent of travelers ventured out for business, and 6 percent journeyed to visit friends and relatives.

Our most recent Survey of Chinese Tourist Attitudes, conducted in November 2022, shows that Chinese tourists have retained their keen desire to explore international destinations. About 40 percent of respondents reported that they expect to undertake outbound travel for their next leisure trip.

Where do these travelers want to go?

The results also indicate that the top three overseas travel destinations (beyond Hong Kong and Macau) are Australia/New Zealand, Southeast Asia, and Japan. Overall, respondents show less interest in travel to Europe than in previous years, down from 7 percent to 4 percent compared to wave 5 respondents. Desire to embark on long-haul international trips to Australia/New Zealand increased from 5 percent to 7 percent, and North American trips from 3 percent to 4 percent since the last survey. The wealthier segment (monthly household income over RMB 38,000) still shows a high interest in EU destinations (13 percent).

There are stumbling blocks on the road to recovery

While travel sentiment is strong, other factors may deter travelers from taking to the skies: fear of COVID-19; the need for COVID-19 testing which can be expensive; ticket prices; risk appetite of destination countries; and getting a passport or visa.

Chinese travelers may favor domestic trips, even if all outbound travel restrictions are removed, until they feel it is safe to travel internationally. A COVID-19-safe environment in destination countries will likely boost travelers’ confidence and encourage them to book trips again.

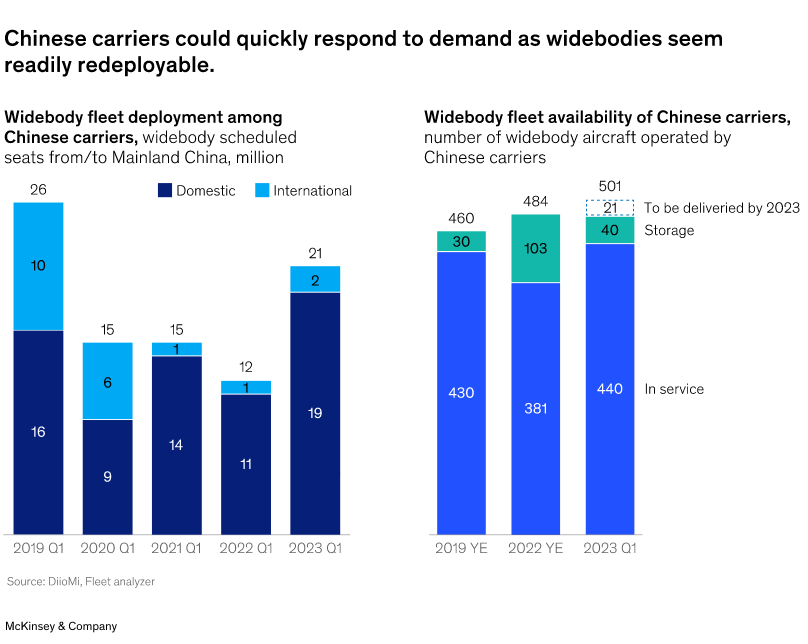

Travel recovery is also dependent on airline capacity. Some international airlines might be slow to restore capacity as fleets were retired during COVID-19 and airlines face a shortage of crew, particularly pilots. Considering that at the time of writing, in April 2023, international airline seat capacity has only recovered to around 37 percent of pre-pandemic levels, travelers are likely to face elevated ticket prices in the coming months. For instance, ticket prices for travel in the upcoming holidays to popular overseas destinations such as Japan and Thailand are double what they were in 2019.11 Price-sensitive travelers might wait for ticket prices to level out before booking their overseas trips.

Chinese airlines, however, appear more ready to resume full service than their international counterparts—fewer pilots left the industry and aircraft are available. Chinese carriers’ widebody fleets are mostly in service or ready to be redeployed (Exhibit 2).

Exhibit 2

Moving forward, safety measures in destination countries will affect travel recovery. Most countries have dropped testing requirements on arrivals from mainland China, and Chinese outbound group travel has resumed but is still limited to selected countries.

Many Chinese travelers—maybe 20 percent—have had passports expire during the COVID-19 period, and China has not been renewing these passports. Renewals are now possible, but the backlog will slow travel’s rebound by a few months. Furthermore, travel visas for destination countries can take some time to be processed and issued.

Taken together, these factors suggest that the returning wave of Chinese travelers may only gather momentum by the Summer of 2023 and that China’s travel recovery will likely lag Hong Kong’s by a few months.

Overall, China is opening up to travel, both inbound and outbound—all types of visas are being issued to foreign visitors, and locals are getting ready to travel abroad.

The returning Chinese traveler is evolving

Although Chinese travelers did not have opportunities to travel internationally over the past three years, they continued to travel domestically and explore new offerings. Annual domestic trips remained at around 50 percent of pre-pandemic levels, amounting to 8.7 billion domestic trips over the past three years. During this time, the domestic market matured, and travelers became more sophisticated as they tried new leisure experiences such as beach resorts, skiing trips, and “staycations” in home cities. Chinese travelers became more experienced as thanks to periods of low COVID-19 infection rates domestically they explored China’s vast geography and diverse experiences on offer.

Consequently, the post-COVID-19 Chinese traveler is even more digitally savvy, has high expectations, and seeks novel experiences. These are some of the characteristics of a typical traveler:

Experience-oriented: Wave 6 of the survey shows that the rebound tourist is planning their trip around experiences. Outdoor and scenic trips remain the most popular travel theme. In survey waves 1 to 3, sightseeing and “foodie” experiences were high on the list of preferences while traveling. From waves 4 to 6, culture and history, beaches and resorts, and health and wellness gained more attention—solidifying the trend for experience-driven travel. Additionally, possibly due to the hype of the Winter Olympics, skiing and snowboarding have become popular activities.

Hyper-digitized: While digitization is a global trend, Chinese consumers are some of the most digitally savvy in the world; mobile technologies and social media are at the core of daily life. COVID-19 drove people to spend more time online—now short-form videos and livestreaming have become the top online entertainment options in China. In the first half of 2022, Chinese consumers spent 30 percent of their mobile internet time engaging with short videos.

Exploration enthusiasts: Chinese travelers are also keen to explore the world and embark on novel experiences in unfamiliar destinations. Survey respondents were looking forward to visiting new attractions, even when travel policies limited their travel radius. Instead of revisiting destinations, 45 percent of respondents picked short trips to new sites as their number one choice, followed by long trips to new sites as their second choice.

Consumers are optimistic, and travel spending remains resilient

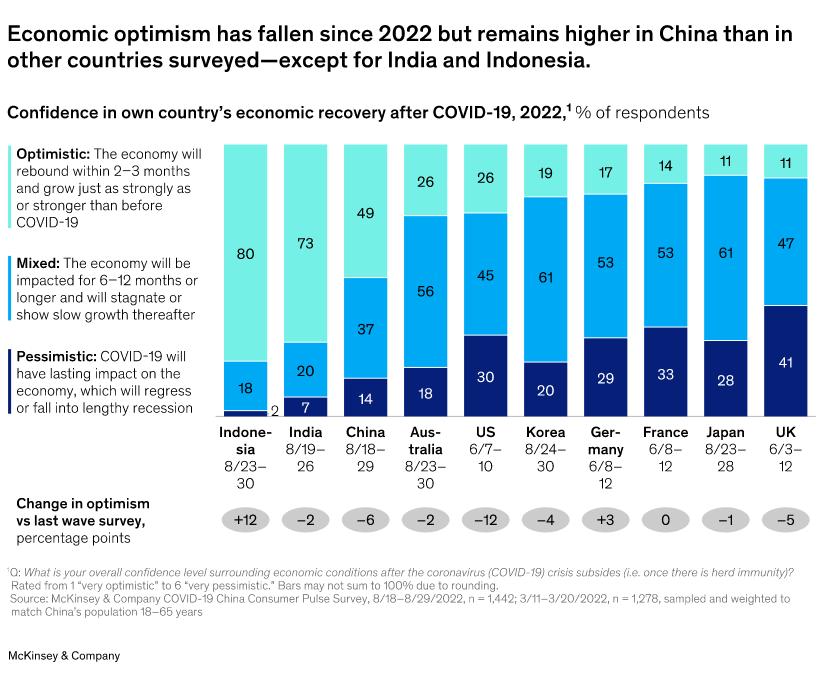

McKinsey’s 2022 research on Chinese consumer sentiment shows that although economic optimism is seeing a global decline, 49 percent of Chinese respondents reported that they are optimistic about their country’s economic recovery. Optimism had dropped by 6 percentage points since an earlier iteration of the survey, but Chinese consumers continue to be more optimistic than other surveyed countries, apart from India (80 percent optimistic) and Indonesia (73 percent optimistic) (Exhibit 3).

Exhibit 3

Chinese consumers are still keen to spend on travel, and travel spending is expected to be resilient. Wave 6 of the tourist attitude survey saw 87 percent of respondents claiming that they will spend more or maintain their level of travel spending. Moreover, when consumers were asked “which categories do you intend to splurge/treat yourself to,” travel ranked second, with 29 percent of respondents preferring travel over other categories.

Against this context of consumer optimism, the wave 6 tourist attitude survey results shed light on how travelers plan to spend, and which segments are likely to spend more than others:

The wealthier segment and older age groups (age 45-65) show the most resilience in terms of travel spend. Around 45 to 50 percent of travelers in these two groups will spend more on their next leisure trip.

The wealthier segment has shown the most interest in beach and resort trips (48 percent). Instead of celebrating Chinese New Year at home with family, 30 percent of Chinese travelers in the senior age group (age 55-65) expect to take their next leisure trip during this holiday—10 percent more than the total average. And the top three trip preferences for senior travelers are culture, sightseeing, and health-themed trips.

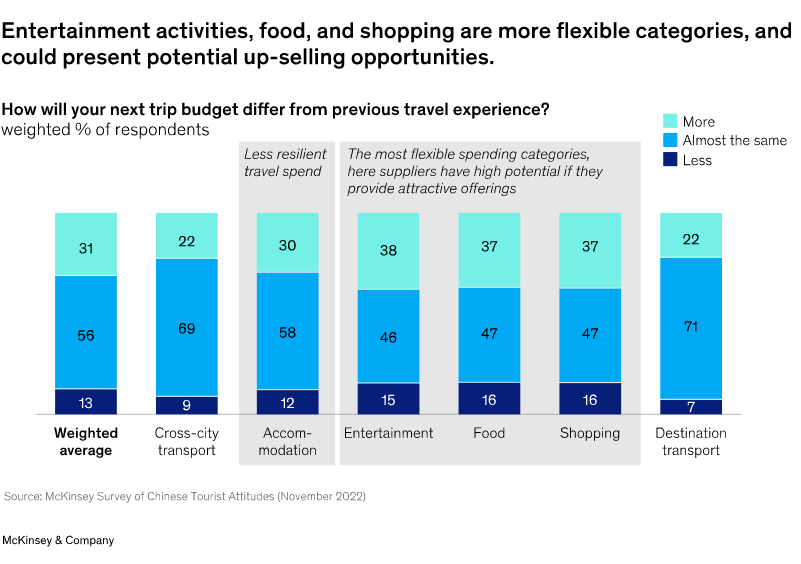

When it comes to where travelers plan to spend their money on their next trip, entertainment activities, food, and shopping are the most popular categories. These are also the most flexible and variable spending categories, and there are opportunities to up-sell—attractions, food and beverage, and retail players are well positioned to create unique and unexpected offerings to stimulate spending in this area (Exhibit 4).

Exhibit 4

Independent accommodation is gaining popularity

Overall, Chinese consumers have high expectations for products and services. McKinsey’s 2023 consumer report found that local brands are on the rise and consumers are choosing local products for their quality, not just for their cheaper prices. Chinese consumers are becoming savvier, and tap into online resources and social media to educate themselves about the specific details and features of product offerings.

Furthermore, 49 percent of Chinese consumers believe that domestic brands are of “better quality” than foreign brands—only 23 percent believe the converse is true. Functionality extended its lead as the most important criterion influencing Chinese consumers, indicating that consumers are focusing more on the functional aspects of products, and less on emotional factors. Branding thus has less influence on purchasing decisions.

These broader consumer sentiments are echoed in the travel sector. Chinese travelers pay attention to cost, but do not simply seek out the lowest prices. While 17 percent of wave 6 respondents are concerned about low prices, 33 percent are on the hunt for value-for-money offerings, and 30 percent prefer good discounts and worthwhile deals.

And consumer sentiment regarding local brands holds true for travel preferences. Independent travel accommodation continues to be the preferred choice for most respondents, increasing in share against international chain brand hotels (Exhibit 5). Almost 60 percent of respondents prefer independent accommodation such as boutique hotels, B&Bs, and Airbnb—an 8 percentage-point increase since 2020.

Exhibit 5

Local chain brand hotels remain stable, the favored accommodation for 20 percent of respondents. These hotels are seen as a more standardized option, and as most are located in urban areas, they target the budget traveler segment.

Opting for independent accommodation is not considered a trade down; Chinese travelers expect a high level of service. In particular, respondents in the wealthier segment picked independent options (57 percent) over international premium brands (27 percent).

Premium independent options for the wealthier segment are abundant, specifically in leisure travel. Setting up a premium brand hotel requires long-term construction periods and heavy capital investment. Small-scale boutique hotels or B&Bs, on the other hand, are more agile solutions that can ramp up in the short term. This may explain the abundance of premium independent offerings. For instance, in destinations such as Lijiang and Yangshuo, between seven and nine of the top-ten premium hotels listed on Ctrip are independent boutique hotels.

Premium independent accommodation’s strength lies in quality guest experience with a genuine human touch. The service level at premium independent establishments can even surpass that of chain brand accommodation thanks to the high staff-to-room ratio, which easily reaches 3:1 or even 5:1.20 For hotels in Xiamen, Lijiang, and Yangshou, Ctrip service ratings of premium independent hotels are all above 4.7, outperforming international chain brand hotels.

Travelers are becoming smarter and more realistic during hotel selection, focusing on fundamental offerings such as local features and value for money. Across all types of hotels, local features are one of the most important factors influencing hotel selection—even for chain brand hotels which have a reputation for mastering the standardized offering. On average, 34 percent of respondents report that local features and cultural elements are the key considerations affecting their choice of hotel.

Outbound Chinese tourists are evolving rapidly, becoming increasingly diverse in their travel preferences, behaviors, and spending patterns. Chinese travelers are not homogeneous, and their needs and preferences continue to evolve. Therefore, serving each group of tourists may require different product offerings, sales channels, or marketing techniques.

How international travel and tourism can attract outbound Chinese travelers

China’s lifting of travel restrictions may cause some uncertainty in the short term, but a promising recovery lies ahead. Chinese tourists have maintained a strong desire to travel internationally and are willing to pay for this experience. They are also discerning and looking for high-quality accommodation, offerings, and service. As boutique hotels are becoming more popular, international hotel brands hotels could, for example, aim to stand out by leveraging their experience in service excellence.

With renewed travel demand, now may be the time for international travel and tourism businesses to invest in polishing product offerings—on an infrastructural and service level. Tourism, food and beverage, retail, and entertainment providers can start preparing for the rebound by providing unique and innovative experiences that entice the adventurous Chinese traveler.

Craft an authentically local offering that appeals to experience-driven Chinese travelers

Chinese travelers have suspended overseas trips for three years, and are now looking to enjoy high-quality experiences in destinations they have been to before. They also want to do more than shopping and sightseeing, and have expressed willingness to spend on offerings geared towards entertainment and experience. This includes activities like theme parks, snow sports, water sports, shows, and cultural activities. Authentic experiences can satisfy their desire for an immersive foreign experience, but they often want the experience to be familiar and accessible.

Designing the right product means tapping into deep customer insights to craft offerings that are accessible for Chinese travelers, within a comfortable and familiar setting, yet are still authentic and exciting.

Travel and tourism providers may also have opportunities to up-sell or cross-sell experiences and entertainment offerings.

Social media is essential

Social media is emerging as one of the most important sources of inspiration for travel. Short video now is a major influence channel across all age groups and types of consumers.

Tourist destinations have begun to leverage social media, and short video campaigns, to maximize exposure. For example, Tourism Australia recently launched a video campaign with a kangaroo character on TikTok, and overall views soon reached around 1.67 billion.

The story of Ding Zhen, a young herder from a village in Sichuan province, illustrates the power of online video in China. In 2020, a seven-second video of Ding Zhen turned him into an overnight media sensation. Soon after, he was approached to become a tourism ambassador for Litang county in Sichuan—and local tourism flourished.21 Another Sichuan local, the director of the Culture and Tourism Bureau in Ganzi, has drawn visitors to the region through his popular cosplay videos that generated 7 million reviews. Building on the strength of these influential celebrities, visitor numbers to the region were said to reach 35 million, more than two-and-a-half times 2016 volumes.

Online travel companies are also using social media to reach consumers. Early in the pandemic, Trip.com took advantage of the upward trend in livestreaming. The company’s co-founder and chairman of the board, James Liang, hosted weekly livestreams where he dressed up in costume or chatted to guests at various destinations. Between March and October 2020, Liang’s livestreams sold around $294 million’s worth of travel packages and hotel room reservations.

Livestreaming is being used by tourism boards, too. For instance, the Tourism Authority of Thailand (TAT) collaborated with Trip.com to launch a new campaign to attract Chinese tourists to Thailand as cross-border travel resumed. The broadcast, joined by TAT Governor Mr Yuthasak Supasorn, recorded sales of more than 20,000 room nights amounting to a gross merchandise value of over RMB 40 million.

International tourism providers looking to engage Chinese travelers should keep an eye on social media channels and fully leverage key opinion leaders.

Scale with the right channel partners

Travel distribution in China has evolved into a complex, fragmented, and Chinese-dominated ecosystem, making scaling an increasingly difficult task. Travel companies need to understand the key characteristics of each channel type, including online travel agencies (OTAs), online travel portals (OTPs), and traditional travel agencies as each target different customer segments, and offer different levels of control to brands. It also takes different sets of capabilities to manage each type of distribution channel.

Travel companies can prioritize the channels they wish to use and set clear roles for each. One challenge when choosing the right channel partner is to avoid ultra-low prices that may encourage volume, but could ultimately damage a brand.

Meanwhile, given the evolution of the postCOVID-19 industry landscape and rapid shifts in consumer demand, travel companies should consider direct-to-consumer (D2C) channels. The first step would be selecting the appropriate D2C positioning and strategy, according to the company’s needs. In China, D2C is a complicated market involving both public domains (such as social media and OTA platforms) and private domains (such as official brand platforms). To make the most of D2C, travel companies need a clear value proposition for their D2C strategy, whether it be focused on branding or on commercial/sales.

Create a seamless travel experience for the digitally savvy Chinese tourist

China has one of the most digitally advanced lifestyles on the planet. Chinese travelers are mobile-driven, wallet-less, and impatient—and frequently feel “digitally homesick” while abroad. Overseas destinations and tourism service providers could “spoil” tech-savvy Chinese travelers with digitally enhanced service.

China’s internet giants can provide a shortcut to getting digital services off the ground. Rather than building digital capabilities from scratch, foreign tourism providers could engage Chinese travelers through a platform that is already being used daily. For example, Amsterdam’s Schiphol Airport provides a WeChat Mini Program with four modules: duty-free shopping, flight inquiry, information transfer, and travel planning. This contains information about all aspects of the airport, including ground transportation and tax refund procedures.

Alibaba’s Alipay, a third-party mobile and online payment platform, is also innovating in this space. The service provider has cooperated with various tax refund agencies, such as Global Blue, to enable a seamless digitized tax refund experience. Travelers scan completed tax refund forms at automated kiosks in the airport, and within a few hours, the refunded amount is transferred directly to their Alipay accounts.

Such digital applications are likely to be the norm going forward, not a differentiator, so travel companies that do not invest in this area may be left behind.

Chinese travelers are on the cusp of returning in full force, and tourism providers can start preparing now

With China’s quarantine requirements falling away at the start of 2023, travelers are planning trips, renewing passports and visas, and readying themselves for a comeback. Chinese tourists have not lost their appetite for travel, and a boom in travel demand can be expected soon. Though airlines are slow to restore capacity, and some destination countries are more risk averse when welcoming Chinese travelers, there are still options for Chinese tourists to explore destinations abroad.

Tourism providers can expect to welcome travelers with diverse interests who are willing to spend money on travel, who are seeking out exciting experiences, and who are choosing high-quality products and services. The returning Chinese traveler is digitally savvy and favors functionality over branding—trends suggest that providers who can craft authentic, seamless, and unique offerings could be well positioned to capture this market.

ABOUT THE AUTHOR(S)

Guang Chen and Jackey Yu are partners in McKinsey’s Hong Kong office, Zi Chen is a capabilities and insights specialist in the Shanghai office, and Steve Saxon is a partner in the Shenzhen office.

The authors wish to thank Cherie Zhang, Glenn Leibowitz, Na Lei, and Monique Wu for their contributions to this article.