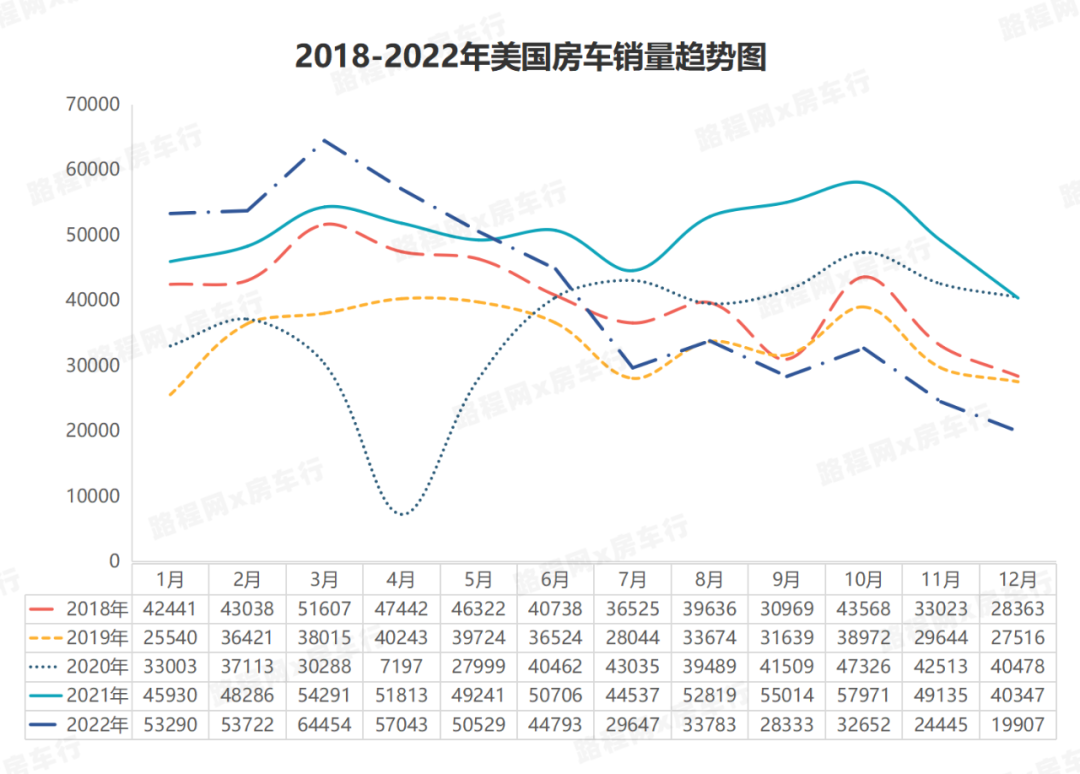

According to the 2022 annual RV sales data released by the RV Industry Association of the United States (RVIA), as of the end of 2022, the sales of RV in the United States totaled 492,598, compared with the highest sales record of 6,090 in 2021, down 17.9% compared with the same period last year; Among them, the total sales volume of trailers was 434,374 units (down 20.1% compared with 543,860 units in 2021), and the total sales volume of self-trailers was 58,224 units (up 3.5% compared with 56,230 units in 2021). In the total sales data for the whole year of 2022, the decline of trailer motorhomes is more obvious, and self-propelled motorhomes have increased slightly compared with previous years.

The decline in sales was concentrated in the second half of 2022, according to Craig Kirby, president and CEO of the RV Industry Association (RVIA) : "Us RV sales in 2022 fell from a historical high in 2021, maintaining strong data in 2021 in the first half of the year, but in the second half of the year, as the industry returned to the production before the beginning of the epidemic, the RV market also gradually returned to normalization in the second half of the year, although the annual sales gap is larger than that in 2021. But 2022 is still the third best year on record."

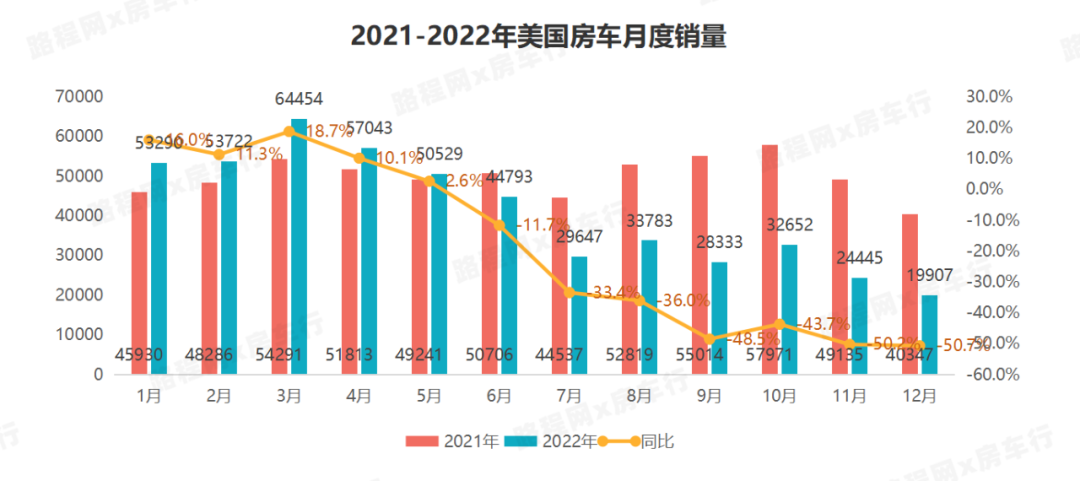

From the point of view of single month data, the United States RV sales from January to April 2022 still maintain the momentum of rapid growth in 2021, the growth rate slowed down in May, followed by high inflation, the United States economic downturn and soaring interest rates, reduced demand and other factors, starting from June, the United States RV sales began to decline to varying degrees.

From June to December 2022, The monthly sales of RV in the United States were 44,793 units in June (down 11.7%), 29,647 units in July (down 33.4%), 33,783 units in August (down 36%), 28,333 units in September (down 48.5%), 32,652 units in October (down 43.7%), and 24,445 units in November (down 33.4%). And 19,907 units in December (down 50.7%). Among them, the single-month sales decline in November and December is more serious, and it is also the lowest monthly sales since the record began in 2018.

The sales decline is mainly concentrated in the trailer RV, self-propelled RV sales are relatively stable, a small increase in previous years, and in the second half of 2022, the proportion of monthly sales significantly increased, but due to national conditions, policies and other factors, the trailer RV future is still the mainstream choice of the US RV market.

Despite the large drop in sales, the US RV Industry Association (RVIA) regards this phenomenon as normal and said in a related report released as early as the first half of 2022: "While sales were strong in the first half of 2022, due to dealers across the country managing inventory, coupled with economic factors, shipments are expected to show varying degrees of decline in the second half, and full-year shipments will gradually normalize from last year's record levels and return to pre-pandemic levels in the second half." And it is expected to continue to maintain a downward trend in 2023.

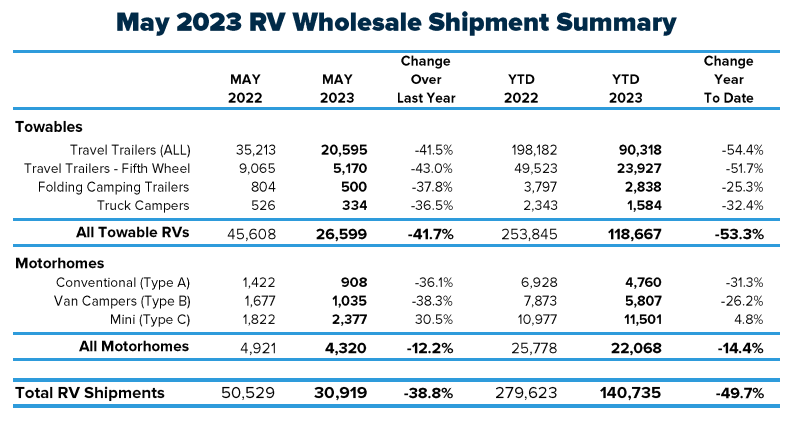

This prediction is also confirmed in the statistics recently released by the RV Industry Association (RVIA), which shows that from January to May 2023, Monthly U.S. RV shipments were 20,405 units in January (down 61.8%), 26,326 units in February (down 51%), 31,869 units in March (down 50.8%), 31,216 units in April (down 45.4%), and 30,919 units in May (down 38.8%).

As of the end of May 2023, total U.S. RV shipments were 140,735 units, down 49.7% from 279,623 units in the same period in 2022. The decline in sales is still concentrated in the trailer RV, as of the end of May, the total shipment of trailers in the United States was 118,667 units, down 53.3% compared with the same period in 2022; The total shipment of self-propelled motorhome was 22068 vehicles, down 14.4% compared with the same period in 2022, it is worth noting that the decline in self-propelled motorhome sales was mainly concentrated in Type A and Type B motorhomes (down 31.3% and 26.2% respectively), and the mainstream domestic type C motorhome in the United States has been a small increase (up 4.8%).

The 2023 U.S. RV market maintains the severe decline trend of 2022, but Craig Kirby, president and CEO of the RV Industry Association (RVIA), believes that the data performance is in line with expectations, and said in a related survey report: "With RV production hitting a record high in the first half of 2022, it was to be expected that 2023 data would report a year-on-year decline. Looking ahead to the RV camping market this year, we see a large number of RV shows, and considering the thousands of younger and more diverse RV enthusiasts who have joined the lifestyle over the past few years, the future of the RV camping market is very bright."

Looking ahead to the rest of 2023, Craig Kirby remains optimistic about the U.S. RV market, saying: "With summer officially upon us, people across the country are using their RVS to create lasting memories with family and friends, and with many affordable RV options available to consumers at RV dealerships across the country right now, RV travel remains one of the most economical ways to travel while also keeping travel costs in check," he said. This is more important to consumers than ever before."

picture